Mortgage Valuation Vs Homebuyer Survey: The Differences

The main differences between a mortgage valuation and a homebuyer survey are that a valuation is a necessary step if you are seeking to take on a mortgage for a home purchase. A survey is entirely optional and gives an idea of how much a property is worth. A mortgage valuation benefits the lender, whereas a homebuyer report is in the interests of the buyer.

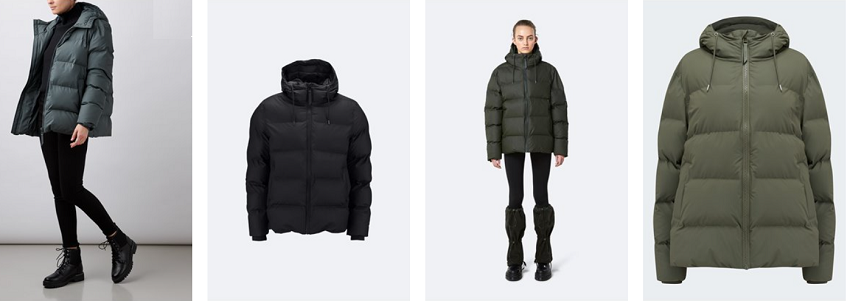

Image Credit

What is a mortgage valuation and why do I need one?

As part of the home-buying process, there are a number of steps that are required. One of these is to obtain a mortgage valuation. Lenders will want to make sure that their money is safe, and they will make a decision on whether the property you are planning to buy is worth the amount you intend to borrow from them. A mortgage valuation is both necessary and u...